https://bakorisfashions.fashion.blog/2022/12/25/hausa-fashion-among-hausa-woman-2/

Hausa fashion among hausa woman

In ancient times cloth weaving requires a lot of skills and patience due to the time consumption, because of that only few or intellectuals can handle that profession, others tends to use other means of body cover as dressing.

HAUSA’s are experts in cloth weaving, as early as 12th to 13th century Hausa people are known for cotton farming which grows well in the vast plans of Hausa land (especially in Funtua, Rano and Kano city state) with high abundance of raw materials makes cloth weaving easier.

Cotton and cotton fabrics was once a huge commodity in hausaland as its traded with many African empires of the time, such as Songhai, Empire, Tuaregs, etc.

Hausawa using their technical skills known as “Azanci” began to produce cotton fabrics in large quantities some for trading with other nation while some for use with in the Hausa community by the Hausas.

These clothes were beautifully coloured with different dyes as evidenced in so many locations of Hausa land one of which was kano dye pits in Kofar mata, which has been in existence from 1498 till date. The Tuaregs have been good customers of Hausa fabrics, because of their love to the colour blue they sometimes referred to as “blue men of the desert”.

Hausa men wear cloths that covers the neck down to the legs it’s called “Riga” “Tagguwa” the hands are usually elongated to cover the entire length of the hands some are armless suited for recreational purposes and “wando” trousers which is tied with “Zariya”.

These are followed with beautifully design caps to cover the head, the caps comes in different design specifying socio-economic class, prestige and maturity.

Then “Babban Riga” is also worn over for special occasion (such as marriage, a visit to in-laws, funerals etc.) and for the elderly sometimes as a show of maturity Hausa women wear women type of “Riga” and “Zanne” wrapper to cover the lower end, which is accompanied by “gyale” veil and “Dan Kwali” head tie.

These set of clothes comes in different colours, sizes, and different weaving style according to socioeconomic class and affordability of many clients.

As it’s a norm for Hausas many of their culture and language is easily accepted and circulated just like Hausa language, these is also the case for Hausa traditional designs which are used by many tribes in Northern Nigeria and many other parts of the African t.

According to an elderly Hausa woman, Hajiya Hussaina Musa residing in Tudun Wada, Kaduna said; “well many things has changed in the made of the Hausa women dressing compared to olden days and that of the present generation because in the olden days you wear the dress that will cover everything in your body in the sense that it will not show your shape or anything about the body” in those days she explained further that your clothe used to have two pair of rapper, a top with long sleeve then you will tie one and use the other as veil.

THAjiya Hussaina made mentioned of the things which include to show fashion in these days Murjani (beat) that was used on their neck and hand “we also used to have what we called awarwaro (bangles) used to decorate the hands. Then there was what we called kwalli (eye pencil) janbaki (lipstick) we also use the kwalli to decorate our face through making some dot in your chicks, on top of your nose.

She said for her the olden days fashion is more preferable because it was very decent and more beautiful. The cloths will comfort you and also brings the beauty in you unlike the present modern way of dressing that although it is also good and makes people to look more beautiful but it’s also to show the nakedness as well as the shape of the ladies.

The impact of the modern dressing in our society made our younger generation to detest the traditional and cultural way of dressing today in our society our girls prefer western dressing with many believing it is the best way to appear in public and look beautiful, even though must elders from at such dressing. They always urge or call on the younger ladies to be proud of their culture.

Hausa fashion among hausa woman

In ancient times cloth weaving requires a lot of skills and patience due to the time consumption, because of that only few or intellectuals can handle that profession, others tends to use other means of body cover as dressing.

HAUSA’s are experts in cloth weaving, as early as 12th to 13th century Hausa people are known for cotton farming which grows well in the vast plans of Hausa land (especially in Funtua, Rano and Kano city state) with high abundance of raw materials makes cloth weaving easier.

Cotton and cotton fabrics was once a huge commodity in hausaland as its traded with many African empires of the time, such as Songhai, Empire, Tuaregs, etc.

Hausawa using their technical skills known as “Azanci” began to produce cotton fabrics in large quantities some for trading with other nation while some for use with in the Hausa community by the Hausas.

These clothes were beautifully coloured with different dyes as evidenced in so many locations of Hausa land one of which was kano dye pits in Kofar mata, which has been in existence from 1498 till date. The Tuaregs have been good customers of Hausa fabrics, because of their love to the colour blue they sometimes referred to as “blue men of the desert”.

Hausa men wear cloths that covers the neck down to the legs it’s called “Riga” “Tagguwa” the hands are usually elongated to cover the entire length of the hands some are armless suited for recreational purposes and “wando” trousers which is tied with “Zariya”.

These are followed with beautifully design caps to cover the head, the caps comes in different design specifying socio-economic class, prestige and maturity.

Then “Babban Riga” is also worn over for special occasion (such as marriage, a visit to in-laws, funerals etc.) and for the elderly sometimes as a show of maturity Hausa women wear women type of “Riga” and “Zanne” wrapper to cover the lower end, which is accompanied by “gyale” veil and “Dan Kwali” head tie.

These set of clothes comes in different colours, sizes, and different weaving style according to socioeconomic class and affordability of many clients.

As it’s a norm for Hausas many of their culture and language is easily accepted and circulated just like Hausa language, these is also the case for Hausa traditional designs which are used by many tribes in Northern Nigeria and many other parts of the African t.

According to an elderly Hausa woman, Hajiya Hussaina Musa residing in Tudun Wada, Kaduna said; “well many things has changed in the made of the Hausa women dressing compared to olden days and that of the present generation because in the olden days you wear the dress that will cover everything in your body in the sense that it will not show your shape or anything about the body” in those days she explained further that your clothe used to have two pair of rapper, a top with long sleeve then you will tie one and use the other as veil.

THAjiya Hussaina made mentioned of the things which include to show fashion in these days Murjani (beat) that was used on their neck and hand “we also used to have what we called awarwaro (bangles) used to decorate the hands. Then there was what we called kwalli (eye pencil) janbaki (lipstick) we also use the kwalli to decorate our face through making some dot in your chicks, on top of your nose.

She said for her the olden days fashion is more preferable because it was very decent and more beautiful. The cloths will comfort you and also brings the beauty in you unlike the present modern way of dressing that although it is also good and makes people to look more beautiful but it’s also to show the nakedness as well as the shape of the ladies.

The impact of the modern dressing in our society made our younger generation to detest the traditional and cultural way of dressing today in our society our girls prefer western dressing with many believing it is the best way to appear in public and look beautiful, even though must elders from at such dressing. They always urge or call on the younger ladies to be proud of their culture.

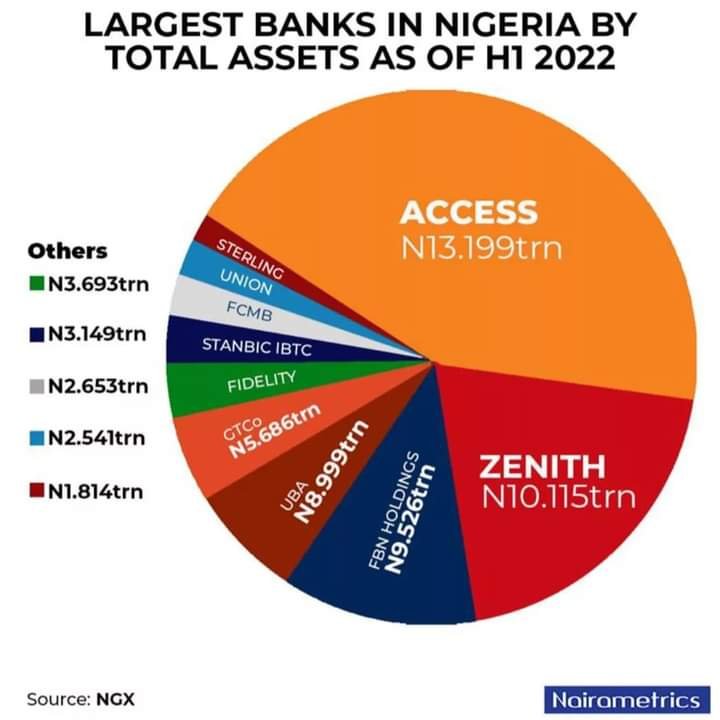

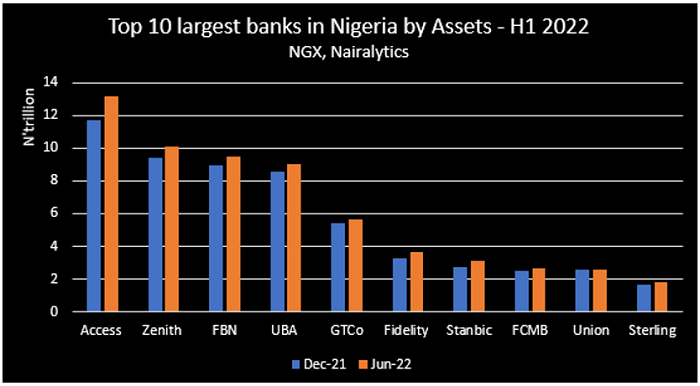

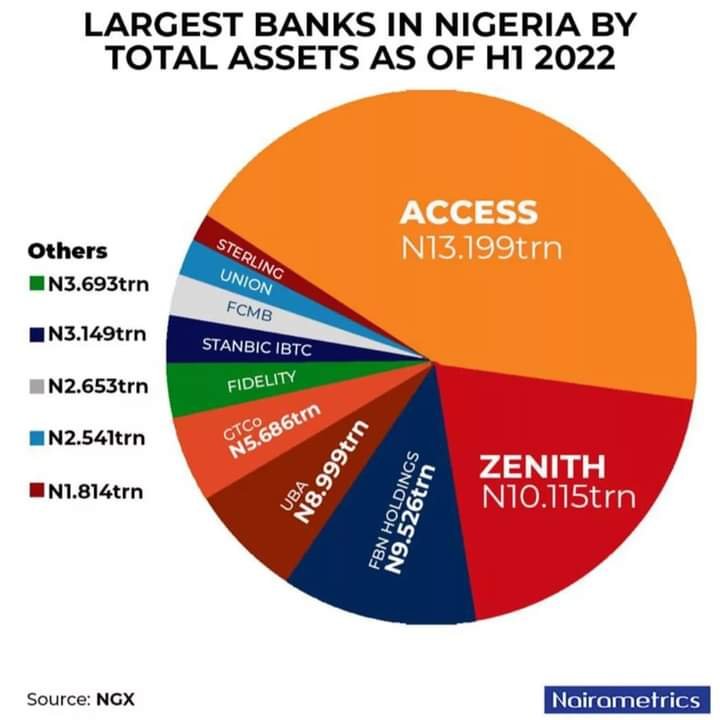

Largest banks in Nigeria by total assets as of H1 2022Research Team

Access Bank, Zenith, and FBN Holdings maintained the top spot as the largest banks in Nigeria based on the value of their total assets as of the first half of 2022. Data compiled by Nairalytics, the research arm of Nairametrics shows.

The thirteen commercial banks listed on the Nigerian Exchange (NGX) with major operations in the country saw their aggregate asset value increase by 8.1% in the first six months of the year to stand at N63.59 trillion as of June 2022 from N58.83 trillion recorded as of the beginning of the year.

The top five banks in Nigeria by total assets are:

The top five banks were the major tier-1 financial institutions typically referred to as the FUGAZ, which is an acronym used to represent First Bank, UBA, GTCO, Access, and Zenith Bank. The top five banks accounted for 80.5% of the total asset of the industry. It is worth noting that Ecobank Transnational Incorporated was not included in the compilation because most of its operations are outside Nigeria.

A further breakdown of the data shows that the increase in the total assets of the banks was largely attributed to rises in customer loans. Although Union Bank recorded a decline in its total assets in the period under review, Stanbic IBTC recorded the highest increase with a 14.8% increase to stand at N3.15 trillion from N2.74 trillion as of the beginning of the year.

#5: GTCO – N5.69 trillion

- The banking giant, which also restructured into a holding company last year saw its cash and bank balances with the Central Bank rise to N1.04 trillion in June 2022 from N933.59 billion as of the end of last year.

- Also, loans to customers increased marginally from N1.8 trillion as of December 2021 to N1.83 trillion by the end of June 2022. Meanwhile, financial assets at fair value through profit or loss improved significantly from N104.4 billion to N262.32 billion

Guaranty Trust Holding Company Plc (GTCO) posted a total asset value of N5.69 trillion as of June 2022, which is 4.6% higher than the N5.44 trillion recorded as of December 2021. GTCO accounted for 8.9% of the total assets of the thirteen banks.

#4: UBA – N8.99 trillion

- UBA accounted for 14.2% of the total asset value of the entire thirteen banks on the list. A further breakdown of the bank’s statement of financial position showed that it’s cash and bank balances improved to N1.98 trillion from N1.82 trillion recorded as of the beginning of the year.

- Also, its loans and advances to customers increased to N2.75 trillion from N2.68 trillion, while loans to banks improved to N198.1 billion as of the period under review. Property and equipment stood at N183.6 billion, while investment securities at fair value stood at N1.63 trillion

United Bank for Africa ranks fourth on the list of biggest banks in Nigeria based on total assets with a value of 8.99 trillion, representing a 5.4% increase from N8.54 trillion recorded by the beginning of the year.

: FBN Holdings – N9.53 trillion

FBN Holdings posted a total asset valuation of N9.53 trillion as of June 2022, representing a 6.6% increase from N8.93 trillion recorded six months earlier. FBN Holdings, which is the parent company for First Bank accounted for 15% of the total aggregate assets for the thirteen banks.

- FBN’s asset growth can be attributed to increasing in its cash and balances, loan books, and investment securities. Its cash and balances with Central Bank rose from N1.59 trillion to N1.64 trillion in the six months period.

- Also, its loans and advances to customers improved from N2.88 trillion as of December 2021 to stand at N3.38 trillion by the end of June 2022. It is worth adding that its investment securities rose to N2.16 trillion from N1.96 trillion.

- On the flip side, its property and equipment declined marginally to N113.79 billion from N115.9 billion recorded as of December 2021.

: Zenith Bank – N10.12 trillion

- The increase in its total assets was as a result of improvement in its cash and balance with the Central Bank, treasury bills, loans to customers as well as investment securities.

- The bank, which is also the most capitalized bank in the Nigerian equities market, saw its loan books increase to N3.49 trillion as of June 2022 from N3.36 trillion, while investment securities stood at N1.48 trillion.

- In the same vein, property and equipment improved, albeit only marginally from N200 billion to N202.3 billion. Investment securities improved from N1.3 trillion recorded as of the beginning of the year to N1.48 trillion by the end of June 2022

Zenith Bank reported a total assetvalue of N10.12 trillion as of June 2022, an increase of 7.1% from N9.45 trillion recorded as of December 31st, 2022. Zenith Bank accounted for 15.9% of the total assets of the banks listed on the Exchange.

1: Access Bank – N13.19 trillion

Access Holdings Plc tops the list with a total asset value of N13.19 trillion as of June 2022, representing an increase of 12.5% compared to N11.73 trillion recorded as of the beginning of the year.

- The financial institution, which is a newly restructured holding company accounted for 20.8% of the total assets of the thirteen banks under consideration. The uptick in the total asset value of the bank can be attributed to improvements in some of the asset components, especially loans and advances.

- Specifically, loans and advances to customers rose to N4.62 trillion as of the period under consideration from N4.16 trillion recorded as of the beginning of the year. This means that Access Bank gave out an additional N458.2 billion in loans to its customers in the first six months of the year.

- Also, investment securities rose by N493.6 billion to stand at N2.76 trillion. The value of its property and equipment increased to N261.8 billion from N247.7 billion, having spent N36.7 billion on the acquisition of property and equipment in the same period.

- Meanwhile, Access Bank has entered into a binding agreement with Centum Investment Company Plc to acquire its entire 83.4% equity stake held by Centum in Sidian Bank Limited.

- Also, the holding company received regulatory approval in August 2022 to acquire a majority equity stake in First Guarantee Pension Limited, in a bid to evolve into a financial service holding company.

Others include

- Fidelity Bank – N3.69 trillion

- Stanbic IBTC – N3.15 trillion

- FCMB – N2.65 trillion

- Union Bank – N2.54 trillion

- Sterling Bank – N1.81 trillion

Related

Largest banks in Nigeria by total assets as of H1 2022Research Team

Access Bank, Zenith, and FBN Holdings maintained the top spot as the largest banks in Nigeria based on the value of their total assets as of the first half of 2022. Data compiled by Nairalytics, the research arm of Nairametrics shows.

The thirteen commercial banks listed on the Nigerian Exchange (NGX) with major operations in the country saw their aggregate asset value increase by 8.1% in the first six months of the year to stand at N63.59 trillion as of June 2022 from N58.83 trillion recorded as of the beginning of the year.

The top five banks were the major tier-1 financial institutions typically referred to as the FUGAZ, which is an acronym used to represent First Bank, UBA, GTCO, Access, and Zenith Bank. The top five banks accounted for 80.5% of the total asset of the industry. It is worth noting that Ecobank Transnational Incorporated was not included in the compilation because most of its operations are outside Nigeria.

A further breakdown of the data shows that the increase in the total assets of the banks was largely attributed to rises in customer loans. Although Union Bank recorded a decline in its total assets in the period under review, Stanbic IBTC recorded the highest increase with a 14.8% increase to stand at N3.15 trillion from N2.74 trillion as of the beginning of the year.

The top five banks in Nigeria by total assets are:

News continues after this ad

5: GTCO – N5.69 trillion

Guaranty Trust Holding Company Plc (GTCO) posted a total asset value of N5.69 trillion as of June 2022, which is 4.6% higher than the N5.44 trillion recorded as of December 2021. GTCO accounted for 8.9% of the total assets of the thirteen banks.

The banking giant, which also restructured into a holding company last year saw its cash and bank balances with the Central Bank rise to N1.04 trillion in June 2022 from N933.59 billion as of the end of last year.

Also, loans to customers increased marginally from N1.8 trillion as of December 2021 to N1.83 trillion by the end of June 2022. Meanwhile, financial assets at fair value through profit or loss improved significantly from N104.4 billion to N262.32 billion.

4: UBA – N8.99 trillion

United Bank for Africa ranks fourth on the list of biggest banks in Nigeria based on total assets with a value of 8.99 trillion, representing a 5.4% increase from N8.54 trillion recorded by the beginning of the year.

UBA accounted for 14.2% of the total asset value of the entire thirteen banks on the list. A further breakdown of the bank’s statement of financial position showed that it’s cash and bank balances improved to N1.98 trillion from N1.82 trillion recorded as of the beginning of the year.

Also, its loans and advances to customers increased to N2.75 trillion from N2.68 trillion, while loans to banks improved to N198.1 billion as of the period under review. Property and equipment stood at N183.6 billion, while investment securities at fair value stood at N1.63 trillion.

News continues after this ad

3: FBN Holdings – N9.53 trillion

FBN Holdings posted a total asset valuation of N9.53 trillion as of June 2022, representing a 6.6% increase from N8.93 trillion recorded six months earlier. FBN Holdings, which is the parent company for First Bank accounted for 15% of the total aggregate assets for the thirteen banks.

FBN’s asset growth can be attributed to increasing in its cash and balances, loan books, and investment securities. Its cash and balances with Central Bank rose from N1.59 trillion to N1.64 trillion in the six months period.

Also, its loans and advances to customers improved from N2.88 trillion as of December 2021 to stand at N3.38 trillion by the end of June 2022. It is worth adding that its investment securities rose to N2.16 trillion from N1.96 trillion.

On the flip side, its property and equipment declined marginally to N113.79 billion from N115.9 billion recorded as of December 2021.

Zenith Bank reported a total asset value of N10.12 trillion as of June 2022, an increase of 7.1% from N9.45 trillion recorded as of December 31st, 2022. Zenith Bank accounted for 15.9% of the total assets of the banks listed on the Exchange.

The increase in its total assets was as a result of improvement in its cash and balance with the Central Bank, treasury bills, loans to customers as well as investment securities.

The bank, which is also the most capitalized bank in the Nigerian equities market, saw its loan books increase to N3.49 trillion as of June 2022 from N3.36 trillion, while investment securities stood at N1.48 trillion.

In the same vein, property and equipment improved, albeit only marginally from N200 billion to N202.3 billion. Investment securities improved from N1.3 trillion recorded as of the beginning of the year to N1.48 trillion by the end of June 2022.

1: Access Bank – N13.19 trillion

2: Zenith Bank – N10.12 trillion

Access Holdings Plc tops the list with a total asset value of N13.19 trillion as of June 2022, representing an increase of 12.5% compared to N11.73 trillion recorded as of the beginning of the year.

The financial institution, which is a newly restructured holding company accounted for 20.8% of the total assets of the thirteen banks under consideration. The uptick in the total asset value of the bank can be attributed to improvements in some of the asset components, especially loans and advances.

Specifically, loans and advances to customers rose to N4.62 trillion as of the period under consideration from N4.16 trillion recorded as of the beginning of the year. This means that Access Bank gave out an additional N458.2 billion in loans to its customers in the first six months of the year.

Also, investment securities rose by N493.6 billion to stand at N2.76 trillion. The value of its property and equipment increased to N261.8 billion from N247.7 billion, having spent N36.7 billion on the acquisition of property and equipment in the same period.

Meanwhile, Access Bank has entered into a binding agreement with Centum Investment Company Plc to acquire its entire 83.4% equity stake held by Centum in Sidian Bank Limited.

Also, the holding company received regulatory approval in August 2022 to acquire a majority equity stake in First Guarantee Pension Limited, in a bid to evolve into a financial service holding company.

Others include

Fidelity Bank – N3.69 trillion

Stanbic IBTC – N3.15 trillion

FCMB – N2.65 trillion

Union Bank – N2.54 trillion

Sterling Bank – N1.81 trillion

Related

Exclusive: Best bank in Nigeria judging by the numbers

June 23, 2020

In “Research Analysis”

Exclusive: Best bank in Nigeria judging by the numbers

September 8, 2020

In “Exclusives”

Zenith Bank blows past Access Bank as customer deposits cross N4 trillion

September 6, 2020

In “Research Analysis”

Categories: Financial Services, Metrics, Rankings

Tags: Featured

Leave a Comment

Nairam

‘Poor parenting skills, poverty leading causes of child abuse’

Against the backdrop of rising cases of child abuse in the country, a professor of Counseling Psychology at Covenant University, Prof. Abiodun Gesinde, has identified lack of parenting skills, poverty, alcohol and drug abuse as leading causes of child maltreatment in the country.

Gesinde made the submission at the institution 13th inaugural lecture held at the Covenant University Chapel, Ota, Ogun State. While delivering a lecture titled ‘Psychological Virus Undermining Children and Adolescents’ Development: The antiviral in Counseling Psychology,’ Gesinde noted that forms of child abuse include physical, sexual, neglect and emotional with physical abuse accounting for about one out of four substantial cases.

According to him, in a study he conducted in 2007 in Oyo State, findings revealed that lack of parenting skills, poverty, alcohol or drug abuse, illiteracy, and divorce, single parenting and separation are top psycho-social factors sustaining child abuse in the country and until they are kept at bay, attempt to eradicating the menace may be a fruitless endeavour.

He said available statistics indicated that 77 per cent of perpetrators of child abuse are parents, 11 percent other relatives, two per cent caretakers and about 10 per cent non-caretakers

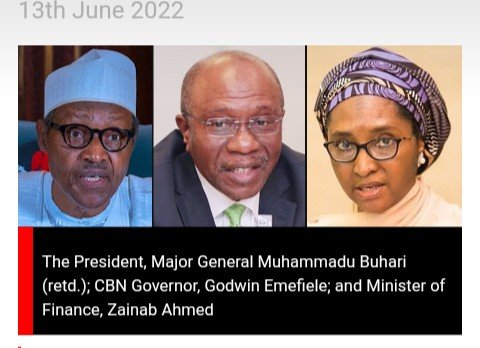

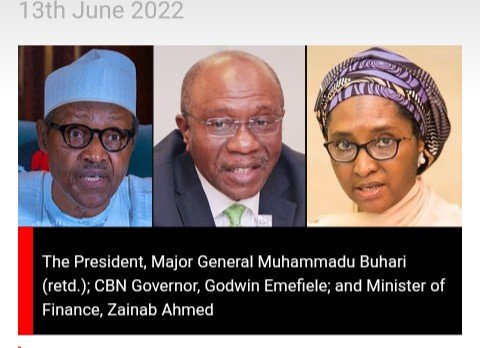

FG’s borrowing from CBN hits N19tn, inflation may worsen – Repor

The Federal Government’s total borrowing from the Central Bank of Nigeria through Ways and Means Advances rose from N17.46tn as of December 2021 to N19.01tn as of April 2022.

According to data from the CBN, this represents an increase of N1.55tn within the first four months of 2022.

The N19.01tn owed the apex bank by the Federal Government is not part of the country’s total public debt stock, which stood at N41.60tn as of March 2022, according to the Debt Management Office.

The public debt stock only includes the debts of the Federal Government of Nigeria, the 36 state governments, and the Federal Capital Territory.

Ways and Means Advances is a loan facility through which the CBN finances the government’s budget’s shortfalls.

According to Section 38 of the CBN Act, 2007, the apex bank may grant temporary advances to the Federal Government with regard to temporary deficiency of budget revenue at such rate of interest as the bank may determine.

The Act read in part, “The total amount of such advances outstanding shall not at any time exceed five per cent of the previous year’s actual revenue of the Federal Government.

“All advances shall be repaid as soon as possible and shall, in any event, be repayable by the end of the Federal Government financial year in which they are granted and if such advances remain unpaid at the end of the year, the power of the bank to grant such further advances in any subsequent year shall not be exercisable, unless the outstanding advances have been repaid.”

However, the CBN has said on its website that the Federal Government’s borrowing from it through the Ways and Means Advances could have adverse effects on the bank’s monetary policy to the detriment of domestic prices and exchange rates.

“The direct consequence of central banks’ financing of deficits are distortions or surges in monetary base leading to adverse effect on domestic prices and exchange rates i.e macroeconomic instability because of excess liquidity that has been injected into the economy,” it said.

In June last year, London-based Capital Economics, in a report titled ‘The perils of deficit monetisation in Nigeria’, noted that over the past six years, on average, around 55 per cent of annual budget shortfalls has been financed by the CBN.

“Many of the problems plaguing Nigeria’s economy – from high inflation to a persistently overvalued currency – are tied to the government’s sustained reliance on the central bank to cover fiscal financing gaps,” it said.

The World Bank had in November last year warned the Nigerian government against financing deficits by borrowing from the CBN through the Ways and Means Advances, saying this put fiscal pressures on the country’s expenditures.

The Washington-based bank added that the Federal Government’s borrowing from the CBN was increasing the cost of debt in the country.

“Cost of debt is high as Federal Government also resorts to overdraft (Ways and Means financing) from the CBN to meet in-year cash shortfalls,” it stated.

It, however, said that the Federal Government was making efforts to negotiate terms with the CBN in order to convert the stock of overdraft financing into a long-term debt instrument, which would lower the cost of debt for the government and enhance fiscal sustainability over the medium-long term.

Despite warnings from experts and organisations, the Federal Government has kept borrowing from the CBN to fund budget deficits.

The PUNCH had reported that the Federal Government paid an interest of N2.03tn from January 2020 to November 2021 on the loans it got from the CBN through the Ways and Means Advances.

Related News

CBN interest rate hike choking MSMEs, say operators

Nigeria’s rising inflation consistent with global trend – Emefiele

CBN disburses N1tn to Anchor Borrowers Programme farmers

A professor of Economics and Public Policy at the University of Uyo, Prof Akpan Ekpo, said there was a need for the government to minimise its usage of central bank financing.

He however noted that “I hope they are borrowing to finance capital projects, not for recurrent expenditure.”

“The ideal thing is to avoid the Ways and Means facility, and most countries avoid that,” he added.

The Managing Director and Chief Executive Officer, Financial Derivatives Company Limited, Mr Bismarck Rewane, had stressed the need for the government to securitise the debt, which he described as quite large.

He said, “What we need to do is to actually securitise this formally. But I think that right now, the Federal Ministry of Finance or DMO is paying interest on the Ways and Means advances. So, the effect is that there is a cost to the borrowing, and the central bank is receiving the interest on it.”

The Managing Director/Chief Executive Officer, Cowry Asset Management Limited, Mr Johnson Chukwu, said the central bank borrowing put pressure on the exchange rate and the inflation rate, with “liquidity that has no productivity attached to it coming into the system.”

He said, “What that means is that the central bank has been struggling with mopping up excess liquidity as a result of injection of liquidity not coming from productive activities but rather from Federal Government’s W&M borrowing.

According to Chukwu, the securitisation of the ways and means advances will further increase the interest obligations of the Federal Government.

“It might be difficult for the Federal Government to securitise those borrowings. The key thing for me is that we need to restructure the fiscal framework of the country so that we take out this dependence by the Federal Government on CBN funding,” he said.

An economist and public sector reforms expert, Dr Chiwuike Uba, who is also the chairman of the Board, Amaka Chiwuike-Uba Foundation, urged the government to reduce its appetite for borrowing.

He said, “The truth is that it will be very difficult to stop borrowing abruptly in light of the situation we are in. However, we must reduce our appetite for borrowing to refocus, redirect and rethink our need for borrowing.”

He further advised the government to adopt other public-private partnership arrangements to implement various capital projects in the country rather than accumulating debts.

A development economist, Aliyu Ilias, said the refusal of the government to remove petrol subsidy had significantly increased expenditure, forcing the government to resort to borrowing to close its widening fiscal deficit.

He advised the government to seek better ways to generate revenue, such as widening its tax net and privatising its assets.

Copyright PUNCH.

All rights reserved. This material, and other digital content on this website, may not be reproduced, published, broadcast, rewritten or redistributed in whole or in part without prior express written permission from PUNCH.

Contact: theeditor@punchng.com

Kindly share this story:

All rights reserved. This material, and other digital content on this website, may not be reproduced, published, broadcast, rewritten or redistributed in whole or in part without prior express written permission from PUNCH.

Contact: theeditor@punchng.com

JOIN THE CONVERSATION

Top News

IGP Baba Usman

BREAKING: Court sentences IGP to three months in prison

February 19, 2022

Singer Slami Ifeanyi shot dead in Anambra

JUST IN: Cameroon’s Onana leaves W’Cup after fallout with coach

APC, Assembly tackle Adeleke, governor sacks 12,000 workers

News

Sports

Metro Plus

Politics

Featured

Latest News

Business

Business & Economy

Opinion

Entertainment

Auto Famous

Auto Punch

Barka Da Sallah

Barrier Breakers

Breaking News

Brexit

Columns

Corona

Anti-corruption

Biafra

Boko Haram

Case Review

Court News

Court Trivia

Campus Champion

Celebrity

City round

Interview

Panorama

Opinion

Special Features

Spice

Technology

Famous Parent

Education

Cartoon

Columns

Diaspora

Advertise with us

Subscribe

Search

Subscribe

punchng.com © 1971- 2022 Punch Nigeria Limited

About us

Advertise with us

Contact

FG’s borrowing from CBN hits N19tn, inflation may worsen – Report13th June 2022

The Federal Government’s total borrowing from the Central Bank of Nigeria through Ways and Means Advances rose from N17.46tn as of December 2021 to N19.01tn as of April 2022.

According to data from the CBN, this represents an increase of N1.55tn within the first four months of 2022.

The N19.01tn owed the apex bank by the Federal Government is not part of the country’s total public debt stock, which stood at N41.60tn as of March 2022, according to the Debt Management Office.

The public debt stock only includes the debts of the Federal Government of Nigeria, the 36 state governments, and the Federal Capital Territory.

Ways and Means Advances is a loan facility through which the CBN finances the government’s budget’s shortfalls.

According to Section 38 of the CBN Act, 2007, the apex bank may grant temporary advances to the Federal Government with regard to temporary deficiency of budget revenue at such rate of interest as the bank may determine.

The Act read in part, “The total amount of such advances outstanding shall not at any time exceed five per cent of the previous year’s actual revenue of the Federal Government.

Plights of girl child education

Yes, the rights and privileges of a girl-child are restricted in terms of so many benefits like education, politics, freedom…However, high percentage of them are exposed to numerous dangers in the society. Some believe education isn’t meant for them. Is it as a result of the old doctrine that is still practiced even to the 21st century?

Let me go down to memory lane. When the colonial masters introduced the education pattern, our forefathers believe educating a girl-child is a waste of money and resources. However, some ‘sees’ it as a taboo or better still, an abomination because they have a strong notion that she will end up in a man’s abode and spend all her life in the kitchen. Funny enough, some cultures, up till now, believe the old doctrine. Should I call this ignorance or a culture that should be eradicated?Looking at the political aspect,the society has turned politics to ‘a-man-job’ restricting females. Thanks to the new generation that are making great changes.

Join me, Let’s see the pain a girl-child is afflicted with in the society.

WHO IS A GIRL-CHILD?

A girl-child is a biological female offspring from birth to the age of eighteen(18) years. This is the age before one becomes a young adult. This period covers the crèche, nursery or early childhood (0 – 5years), primary (6 – 12years) During these period, the child is under the care of an adult who may be her parents or guidance and ‘older sibling(s)’ it is made up of infancy, childhood, early and late stage of adolescence. During these period, the child is malleable. she tends to develop her personality and character,she is very dependent on others;these on whom she models her behaviour through observation, repetition and imitation. Her physical, mental, social, spiritual and emotional developments start and progress to get to the peak at the young adult stage.

However, back then in history, even up till today in some cultures, a girl-child is seen as nothing. Our forefathers wanted a son and not a daughter which contributes to the rate at which polygamous marriage increased in the past. Then, men married more than one wife just to ‘produce’ a male child. Some women are called names because of their inability to produce a male child.Tell me, are they God?

The society has placed so much pain on a girl-child which includes:

EDUCATION:

What Is Education?

Education is a process of providing information to an inexperienced person to help him/her develop physically, mentally, socially, spiritually, politically and economically.

It is also seen as the process through which an individual is made functional members of the society. It is a process which an individual acquire knowledge and realises his/her potentialities to be useful for his/her self and others.

Education is a fundamental human right which should be enjoyed irrespective of the gender. Women in Nigeria have various challenges in obtaining equal education in all forms of formal education. Education in a basic human right and has been recognized as such since the 1948 adoption of the universal declaration on human right whereas, rapid socioeconomic development of a nation has been observed to depend on the calibre of women and their education in that country. There are lot of human right instruments that provide for education as a fundamental right (1948)

However, the importance of education in the life ofa girl-child cannot be overemphasized.Many girls today do not have adequate education. In some region where girls are at the range of 12-14years, the elders in the community presumes that ‘she is ripe for marriage’ and their words are LAW; so, tell me what worth are her words when the elders have spoken? Thus, depriving her of her freedom of expression as embedded in the constitution of the Federal Republic of Nigeria 1999 section 39(1).

The nature traditional philosophy is that a woman’s place is in her husband kitchen and her primary role centres on her home. This belief has kept many girls away from education. When a girl is given out at a very tender age to a man old enough to be her grandfather, her right as a woman has been abused as most Nigerian would say ‘she don marry her grandpa.’ Also, her right of being educated has been deprived and would be doomed to be an illiterate forever if her husband does not give her the opportunity to be educated after the union. Female education serves as an investment that will help facilitate the achievement of family planning objectives and production of heathier children.

Educating a girl-child translates to better health of the future generation. Also, Education bestows on women (is) a disposition of a lifelong acquisition of knowledge, values, attitudes, competence and skills. Reduction in child’s mobility and mortality thus triggering a snowball effect of achieving all other sustainable development goals in a viable manner. The girl-child needs to be educated to acquire knowledge and skills needed to advance her social status for social interaction and self-improvement. Investing in a girl-child education is vital to driving human capital development in the country. Think about great professionals like Dr(Mrs) Eniola Fadayomi, Prof. Bolanle Awe, Dr Ngozi Okonjo Iweala, Dr Obiageli Ezekwesi, Mrs Omobola Johnson, Dr Sarah Alade and many more are products of great investments in girl-child education.

CHILD ABUSE:

The Federal Child Abuse Prevention and Treatment Act (CAPTA) (42 U.S.C.A. § 5106g), as amended by the CAPTA Reauthorization Act of 2010, defines child abuse and neglect as, at minimum:

“Any recent act or failure to act on the part of a parent or caretaker which results in death, serious physical or emotional harm, sexual abuse or exploitation”; or

“An act or failure to act which presents an imminent risk of serious harm.”

child abuse can be seen in two forms in this article which are:

EARLY MARRIAGE.

This is another danger a girl-child is exposed to in the society.

Under the Child Rights Act 2003, the minimum legal age of marriage is 18 years. Also, in African Children’s charter under section 21(2) which states:

‘child marriage and the betrothal of girls and boys shall be prohibited and effective action, including legislation, shall be taken to specify the minimum age of marriage to be 18 years and make registration of all marriages in an official registry compulsory.’

However, the Child Rights Act prohibits both the marriage of those considered to the children and betrothal of children. In relations to child marriages part iii section 21 states:

‘no person under the age of 18 years is capable of contracting a valid marriage, and accordingly a marriage so contracted is null and void and of no effect whatsoever.’

Under the marriage act 1990, the minimum legal age of marriage is 21years for girls, although they are able to marry before the age with the consent of a parent or guardian.

Early marriage is mostly practiced in the northern part of Nigeria. In the northern part of Nigeria, 48% of hausa-fulani are married by age 15 and 78% are married off at the age of 18. This appalling statistics led Elizabeth to describe the life of a girl-child in northern Nigeria as ‘pathetic.’ However, to buttress her assertion, she maintained that while the ideal marriage of women, although it varies between 20 and 26 years old. In the northern part, where children who have started menstruating are considered mature for marriage and the case of menstruation varies as a girl of 12years can be given out of marriage based on the fact that she has started menstruating.

In the precolonial era, rigid ideas on gender were impulse on African mind. The women’s role was mainly for sexual and commercial labour, satisfying the sexual needs of her man, working on the field, tending the babies and preparing food. How can a girl who is not up to 18 years be able to do all these and look after her so called family?

A girl given out at a tender age is placed at a very high risk. Do you want to tell me a 13years old is ready to be a mother? What does she know about family life? Obviously the skills that she should have learnt to be a better mother isn’t there.

Nigeria has signed and ratified international and instrument which regulate the rights of children. Nigeria ratified the Convention of the Right of a Child (CRC) on 16th of April 1991, and the African charter on the right and welfare of the child (African Children’s Charter) on 12thJuly 2001. Additionally, Nigeria took steps to domesticate both instrument in the form of the Child Right Act (CRA) but despite these, early marriage is still seen as a legal act in some communities.

An important clause which can be invoked against child marriage is section 24(3) of CRC, which states:

‘state parties shall take all effective and appropriate measures with a view to abolishing traditional practices prejudicial to the health of children’

The provision is perhaps the most relevant clause against child marriage, given that the hausa-fulani practice of child marriage is part of their tradition as this traditional practice is detrimental to the health of the girl.

Also, under section 21(18) of the African children’s charter, states parties are urged to

‘…take all appropriate measures to eliminates harmful social and cultural practices affecting the welfare, dignity, normal growth and development of the child in particular:

Those customs and practices prejudicial to the health or life of the child; and

Those customs and practices discriminatory to the child on the ground of sex or other status.

Early marriage should be outlawed, and parents should be educated about the benefits of later marriage. a national children’s commission should be set up for defending the rights of girl child in an educational, social, cultural, political and economic context. The commission should maintain statistics of a child survival and other socioeconomic factors. Parent have an important role to fulfil in helping female children achieving the basic necessities of survival, development and in learning about the fundamental rights of child development and care. Also, teachers have an important role to play in teaching about early marriage.

(2) Rape

Rape can be define using the following references:

Under the Criminal Code of Nigeria (Section 357 & 358), Rape is defined as

‘having unlawful carnal knowledge of a woman or girl, without her consent, or with her consent if the consent is obtained by force or by means of threats or intimidation of any kind, or by fear of harm, or by means of false act, or, in case of a married woman, be personating her husband.” This offence is punishable by imprisonment for life, with or without caning.’

Under the Penal Code of Nigeria (Section 282),

“A man is said to commit rape when he has sexual intercourse with a woman in any of the following circumstance: against her will; without her consent; with her consent, when the consent is obtained by putting her in fear of death or of hurt.”

Under the Criminal Laws of Lagos State (Section 258) which states,

“Any man who has unlawful sexual intercourse with a woman or girl without her consent, is guilty of the offence of rape”

Under the Violence Against Persons Prohibition Act (Section 1)

“A person commits the offence of rape if he or she intentionally penetrates the vagina, anus or mouth of another person with any other part of his/her body or anything else without consent, or the consent is obtained by force”

Rape and sexual assault are serious crimes against the dignity and sexual autonomy of the next person. Every individual has the right and choice to make informed decisions about their sexual conduct and also to respect the rights and dignity of others. We can see from the legislations above that consent is a predominant factor when it comes to offences of rape and sexual assault.

We can also note that the VAPPA (Violence Against Persons Prohibition Act) is quite progressive as it makes provisions for both male and female sexual offenders. It also takes into consideration in another section the rape of a person by a group of people which is the first of its kind in Nigerian laws.

With regards to the prosecution and conviction of sexual offenders, it is unbelievable that despite the prevalence of rape and sexual violence in our society, there have been only 18 reported convictions in Nigeria till date.It goes to show that a lot of people are ignorant of the law, it shows that rape has become normalized to the point that survivors do not feel the need to report. It also shows that there is little or no belief in the justice system.

On November 17th 2014, a four-year-old girl was ganged-raped by her school staff. The gruesome incident goes to highlight the suffering of girl child. According to recent report by a child right NGO, sexual abuse against the child surpasses that against the male one, a fact which relegate the former as the more socially disadvantaged member in the society.

In order for us to have an increase in the rate of prosecution and convictions of sexual offenders there needs to be an increase in advocacy. Survivors especially the females need to be aware of their rights as citizens, they need to know that justice can be achieved and that the perpetrator can be punished for this crime. It is important to note that rape can happen to anyone but it is never the fault of the survivor. It does not matter what she was wearing, where she was or what she was doing – it is always the fault of the perpetrator/rapist as rape is a conscious decision. I know a girl raped at the age of ten when she was still a kid; tell me what might have attracted the perpetrator to her if not for the devilish desire.

A girl child is exposed to this life especially those from broken homes. When a girl is raped, it can lead to so many effects which can be sexually transmitted diseases like HIV/aids, syphilis, gonorrhoea etc. it can also lead to unwanted pregnancies which can cause emotional trauma or worse to the victim.

(c) Child trafficking

Trafficking in children is a form of human trafficking and is define by The United Nations as the recruitment, transportation, transfer, harbouring and/or receipt kidnapping a child for the purpose of slavery, forced labour and exploitation for the purpose of prostitution, sexual exploitation, forced labour or services, slavery servitude or removal of organ which goes against the law.

Section 34(1) of the federal republic of Nigeria 1999 states:

Every individual is entitled to respect for the dignity of his person, and accordingly

No person shall be subject to torture or to inhuman or degrading treatment:

No person shall be held in slavery or servitude; and

No person shall be required to perform forced or compulsory labour.

Human trafficking has been described as a modern day form of slavery. Trafficking involves the transport or trade of people within and across boarders for the purpose of forcing them into slavery conditions.

The effect and consequences of child trafficking in Nigeria is still having its toll in children especially the girl-child who are indeed the leader of their family and the society at large despite the domestic laws enacted by the government to fight the practice. However, the causes of child trafficking are nothing but poverty, ignorance, illiteracy, unemployment, corruption, greed, peer group pressure, broken homes, family size and many more. These factors make children to migrate elsewhere for better opportunities. It usually drives people to leave a region in search for better life elsewhere. The destination of the migrant is usually at bigger cities. Sometimes the economic situation is such that most parents are unable to care and properly feed their family; in the process, some fall a victim to the bogus promises of a good time abroad with the prospect of earning foreign exchange that will be converted into tons of naira in Nigeria and because of that, some have sold their child especially their girl-child to unknown slavery or prostitution. Although Nigeria has enormous human and natural resources as well as the largest oil producer in Africa and the eleventh largest in the world, It is related as one of the poorest country in the world with GDP per capital of about US$150 million with about two-third of the population living in rural areas without basic amenities such as electricity, hospital, school, poor drinking water etc. and earning less than $1 per day so due to this, they subject their children especially the girl child to various forms of labour including trafficking for economic gain.

Girl trafficking is one of the dangerous illegal practice which should be totally eradicated.

CONCLUSION

The society have placed so many plight on the girl-child which some are explained in the above article. The girl-child faced so many dangers in the society which ranges from the family and down to the society; these have make them vulnerable to Poor nutrition, vulnerability to diseases, poor physical and mental development, inferiority complex, fear, emotional trauma just to mention but few. However, these hazards should be looked into and more governmental forces should be empowered to fight against such act. Let’s note that Investing in girl’s education transforms the communities, countries and the entire world; Girls who are educated are more likely to (live) healthy and productive lives. Early marriage is never a way out and obviously a culture that should be eradicated. Rape, ‘the culture of today,’ should be stopped! Beliefs must be changed about the value of girl-child education. There should be elimination of gender bias!

REFERENCE

o Anyanwu; and Scand J Altern., ‘the girl-child: problems and survival in the Nigeria context’ March-June 1995 available at accessed on 9th August, 2020.

Plight Of The Girl Child November 19, 2014 available attribune.com.pk accessed on 9th August,2020.

Criminal Code

Kemi DaSilva-Ibru., ‘WARIF Women at Risk International Foundation’ September 22, 2019 available at accessed on 9th August, 2020.

danchurchaid.org accessed on 9thAugust, 2020.

the value of girl-child education in Nigeria, Monday august 13, 2018 available at http://www.proshareng.com accessed on 17th July 2020

Mercy Dominic., ‘Girl Child Education: A Central Key To The Drive For Nigeria’s Development’ February 10, 2019 available athttp://www.proshareng.comaccessed on July 17 2020.

Constitution of The Federal Republic of Nigeria 1999

Abdulrahman and Oladipo A. R., ‘Trafficking in Nigeria: A Hidden Health and Social Problem in Nigeria’ (2010) international journal of sociology and anthropology vol. 2

‘’improving Women’s Education in Nigeria’’ asec-sldi.org accessed on 11 August 2020

‘Universal Declaration Of Human Rights’ available atamnesty.org accessed on 11 Aug. 2020

unicef.org accessed on 11th August, 2020.

‘Definitions of Child Abuse and Neglect in Federal law’ available at childwelfare.gov accessed 20th August, 2020.

girlsnotbrides.org accessed on August 20, 2020

Violence Against Persons Probation Act (VAPPA), 2015

Criminal Code of Lagos State

Penal Code of Nigeria

Criminal Code of Nigeria, 1990

African Children’s Charter

Child Right Act(CRC) 2003

Convention of the Right of a Child (CRC) 1989

Oluwaleye Adedoyin Grace writes from Faculty of Law, Ahmadu Bello University, Zaria